Knowledge Base

Nigeria Ecosystem Knowledge

-

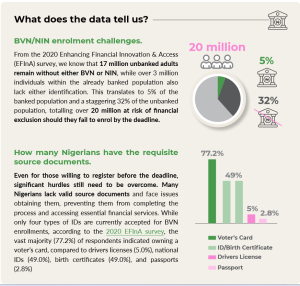

On 1 December 2023, the Central Bank of Nigeria (CBN) announced that it would freeze accounts without a Bank Verification Number (BVN) or National Identification Number (NIN) from April 2024. This "Post no Debit or Credit" freeze will apply to all existing Tier-1 accounts or wallets without BVN or NIN. All unfunded bank accounts or wallets without NIN or BVN are to be placed on “post no debit or credit” immediately and come April 2024, all funded Tier-1 accounts will no longer be able to make withdrawals, transfers, or debits without validated NIN or BVN. Previously, only Tier-2 and 3 accounts and wallets were required to have BVN or NIN.

-

A joint study by Innovations for Poverty Action (IPA) and Inclusion for All investigated three key barriers preventing many from joining the formal financial system: the reliability of financial services, the cost of using these services, and the limited transparency of cost information.

-

Research ICT Africa and the Centre for Internet and Society (CIS) partnered in 2020 and 2021 to investigate, map, and report on the state of digital identity ecosystems in 10 African countries.

-

An independent report commissioned by VerifyMe and developed by Dalberg Advisors between July 2021 to November 2021. It represents a stock-taking of the state of and opportunities within the digital ID and eKYC industry in Nigeria.

-

The overarching goal of this survey was to understand the true cost of NIN enrolment to the NIMC Frontend Enrolment Partners (FEPs), who are mandated to enrol Nigerians within specific geographic areas, and to assess an appropriate incentive structure that would increase enrolment operations in rural communities.

-

An I4ALL study conducted by the International Institute of Tropical Agriculture (IITA). The goal of this research study was to investigate the level and impact of exclusion of female agricultural workers/farmers and traders, particularly in terms of their access to official identification and thereby restrictions on their participation in the formal financial system in Nigeria. View the summary slides here and the full report report here.

-

Reports released by Nigeria's National Identity Management Commission monthly, providing an update on the Number of Nigerian's enrolled in the National Identity Number programme

-

A series of seven bi-annual household survey's conducted by EFInA to track progress towards financial inclusion targets in Nigeria.

-

ID4Africa is an NGO that works with African governments and identity stakeholders to develop robust and responsible identity ecosystems. They conduct regular events to bring together key stakeholders to discuss critical sector issues.

-

This report by the GSMA maps out the barriers to identification, with a specific focus on women, across 10 African countries including Nigeria.

Regional & Global Ecosystem Knowledge

-

This State of Inclusive Instant Payment Systems (SIIPS) in Africa 2023 report is published by AfricaNenda and its partners, the World Bank and the United Nations Economic Commission for Africa (UNECA). It is the second annual report to assess the landscape and inclusivity of open-loop, instant payment systems (IPS) in Africa. It combines a cataloguing of IPS in Africa with consumer research in five countries (Cameroon, Malawi, Morocco, Rwanda and Senegal), insights from expert interviews across the continent, and detailed case studies from Malawi, Rwanda, Zambia, and the Economic and Monetary Community of Central Africa (CEMAC) region, to provide an overview of key trends, barriers, and opportunities for IPS in Africa.SIIPS_2023_Main_Report_ENG_2023-11-15-142759_gfdi

-

An EFInA report comparing financial inclusion models in Nigeria, India and Kenya, highlighting potential opportunities in the Nigerian market.

-

Six insights from the 2021 World Bank Global Findex Data

-

To better understand the nature of the ‘global identification challenge’, the World Bank’s Identification for Development (ID4D) initiative partnered with the Global Findex team to gather survey data across 97 countries about ID coverage, barriers to obtaining one, and their use.

-

The World Bank estimates that roughly one billion people lack an official foundational identification. These one billion people are unable to prove their identity (ID), and millions more have forms of identification that cannot be reliably verified or authenticated, resulting in exclusion from economic opportunities – such as those being created by the emerging digital economy – as well as social and political rights.

-

The findings in the report are based on detailed assessments of identification systems (IMSAs) in 17 countries, and reveal a wide range of identity system types and levels of development across the continent.

-

This report explores KYC innovations in a select number of Alliance for Financial Inclusion (AFI) member countries that are advancing financial inclusion and financial integrity, particularly where this impacts women and marginalized groups.

-

Building on existing international norms, the Principles were first developed and published in 2017 by a group of organizations committed to supporting the development of identification systems that are inclusive, trusted, accountable, and used to enhance people’s lives and the achievement of the Sustainable Development Goals (SDGs).

-

This report develops a framework to understand the potential economic impact of digital ID, informed by an analysis of nearly 100 ways in which digital ID can be used, with deep dives into seven diverse economies: Brazil, China, Ethiopia, India, Nigeria, the United Kingdom, and the United States.